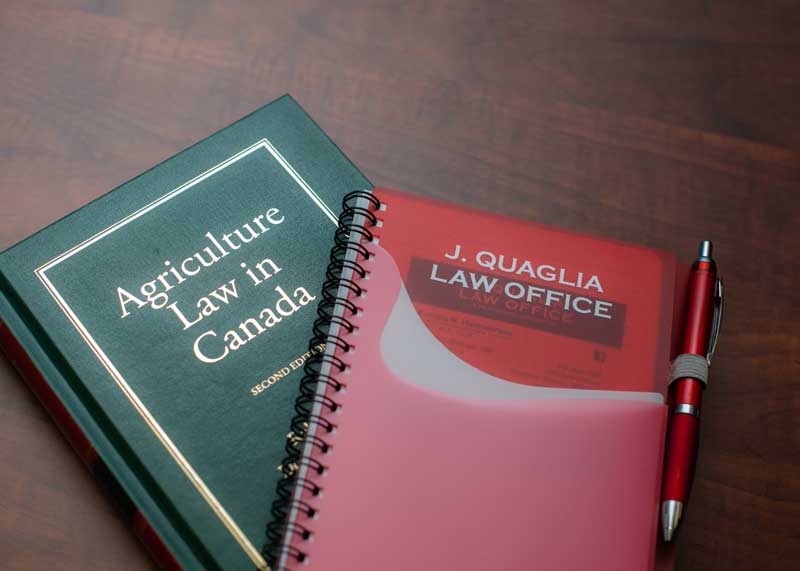

J. Quaglia Law represents many of the largest commercial landowners and farmers in Chatham-Kent as they buy and sell various properties. We represent a number of residential and commercial property developers through the process of Official Plan Amendments, rezoning, first applications, and the registration of subdivisions. Each year for decades the firm closes hundreds of commercial, residential, and farm real estate transactions.

Jon’s experience as a real estate lawyer is important to you, because …

- the real estate you own likely represents your family’s largest financial investment.

- your closing day will likely be crazy and stressful and the one thing you want to have confidence in… is the lawyer closing your deal.

- occasionally even the best laid out plans go awry, and if that happens on your transaction, you will be pleased to have a lawyer with years of experience on your team who will encourage you to keep calm while he pulls the transaction together.

Jon encourages potential clients to contact him early on in the real estate process.

Jon drafts many purchase/sale agreements. Jon and his team will help you ensure the conditions set out in the agreement can be met and waived in a timely manner. Jon will advise you on your options for holding title, and he will outline the steps he and his team will undertake and the work that you need to complete in order to successfully close your real estate transaction.